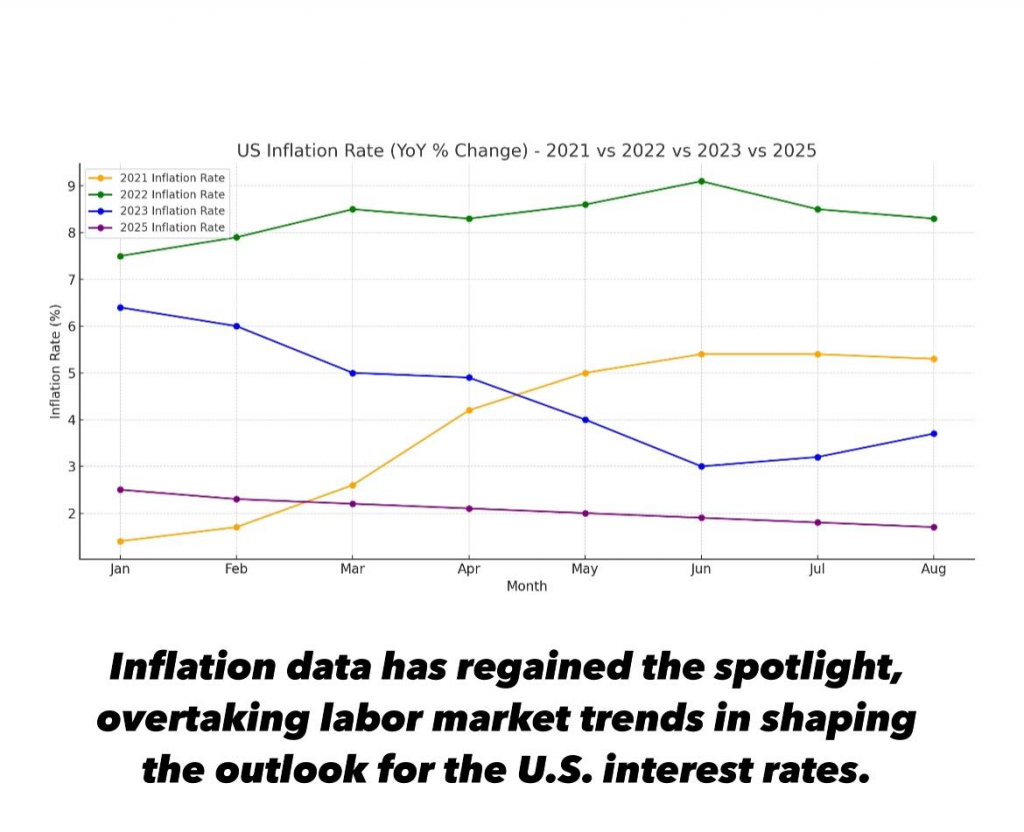

ICYMI **Recently, inflation data has regained the spotlight, overtaking labor market trends in shaping the outlook for the U.S. interest rates.**

According to one portfolio manager, the critical question for market participants is whether a potential 50-basis-point rate cut signals that a recessionary environment is more likely than the Federal Reserve is comfortable with.

The August Consumer Price Index (CPI), due on Wednesday, could decide whether the Federal Reserve opts for a larger-than-usual 50-basis-point rate cut on September 18, a move not seen since the financial crisis of 2008.

One primary concern for investors is whether a softer inflation reading, potentially leading to such a cut, would be interpreted as positive or negative news. The latest jobs report showed fewer-than-expected job gains, reinforcing the view that the labor market is cooling.

However, Jay Hatfield, CEO of Infrastructure Capital Advisors, believes Friday’s jobs data makes a half-point rate cut unlikely. He stated that if the Fed does implement such a cut, it would indicate that a recession is almost inevitable.

Financial market participants will closely monitor Wednesday’s CPI report, which could either confirm or challenge expectations for a 50-basis-point cut.

Keith Buchanan, Senior Portfolio Manager at Globalt Investments, noted, “The $64,000 question is whether a 50-basis-point rate cut would signal that we’ve gone too far with 5%-plus interest rates and whether a recession is more likely.”

The market will also be laser-focused on Fed Chair Jerome Powell’s post-meeting remarks on September 18 to gauge the Fed’s concern about a potential economic slowdown.

For now, Wall Street is expecting good news on inflation. Teams at Barclays and BofA Securities forecast an annual CPI rate between 2.5% and 2.6%, down from July’s 2.9%.

Treasury inflation-protected securities (TIPS) yields have been dropping, reflecting market sentiment around inflation and borrowing costs. Many investors, including William Huston of Bay Street Capital Holdings, are hopeful for a rate cut, citing the global pullback in consumer spending and business investment.

With critical economic data releases throughout the week, including wholesale inventories, jobless claims, and the producer-price index, all eyes will be on the CPI report to shape the Fed’s next move.

Here is a comparison of the US inflation rates for 2021, 2022, 2023, and the hypothetical projection for 2025. The chart highlights the rise in inflation during 2022, the stabilization in 2023, and the projected decline for 2025.